Yeah, I'm not sure what kind of "business" HGTY is in, but if insurance it won't be for long, as

@Jlaa rather expertly points out. My best guess is they're trying to set up some sale of part or all of their business (e.g., the classic car insurance business) to one of the major players (e.g., GEICO). Time will tell, but I too put these types of articles into the category of "shameless self promotion."

maw

EDIT... is HGTY's classic car insurance business all or part of its business? I'm going to go with "all or substantially all."

I just tried to read through the 10Q while waiting for my kid to finish "Dragon Boat Racing" practice.

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001840776/52ad4a57-c9fd-43a6-9052-ee7d463b1841.pdf

Description of Business — Hagerty, Inc. ("Hagerty" or the "Company") and its consolidated subsidiaries, including The Hagerty Group, LLC ("The Hagerty Group"), is a global market leader in providing insurance for classic and enthusiast vehicles. In addition, Hagerty provides an automotive enthusiast platform that engages, entertains and connects with car enthusiasts and its members.

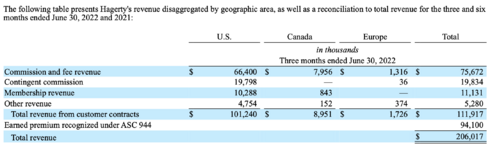

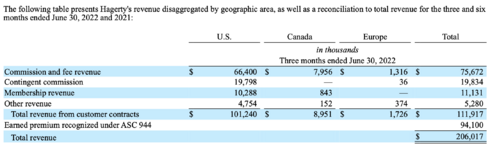

The Company operates several entities which collectively support Hagerty's revenue streams. Hagerty earns commission and fee revenues for the distribution and servicing of classic automobile and boat insurance policies written through personal and commercial lines agency agreements with multiple insurance carriers in the United States ("U.S."), Canada and the United Kingdom ("U.K.").

...

The Company earns subscription revenue through membership offerings and other automotive services sold to policyholders and classic vehicle enthusiasts. Membership offerings include, but are not limited to, private label roadside assistance, digital and linear video content, an award- winning magazine, valuation services, exclusive events and automotive third-party discounts. The Company owns and operates collector vehicle events, earning revenue through ticket sales, sponsorships, and event registration service fees through Motorsport Reg. The Company also owns and operates a peer-to-peer classic vehicle rental business for auto enthusiasts, and operates Member Hubs Holding, LLC ("MHH"), which are majority-owned world-class vehicle storage and exclusive social club facilities branded as Hagerty Garage + Social for classic, collector and exotic cars owners.

In January 2022, the Company entered into a joint venture with Broad Arrow Group, Inc., a Delaware corporation ("Broad Arrow") that enhances the Company's portfolio of automotive-focused offerings for car enthusiasts under Hagerty Marketplace by offering new services for the buying, selling and financing of collector cars to compliment the Company's automotive-focused offerings. Refer to Note 18 — Subsequent Events for additional information.

So yeah, mostly car insurance with some "other" stuff media stuff and event ticket sales. Look below. Most of the revenue is commission and fees from insurance. Like only 5-8% of revenue is from the "other stuff". Almost half of HGTY's revenue is from ASC 944, which I think is some kind of FASB treatment on short-term insurance contracts.

Check out this though:

Yikes. Translation to my uneducated self - "our accounting standards are weak and opaque". Yikes Yikes Yikes Yikes Yikes Yikes

Note here below "business combination". The gobbledygook below is that Aldel Financial Company was the SPAC entity (a corporation with no operations) that had attracted a bunch of capital from big names. Aldel (the SPAC - which was just a container with a ton of capital) and Hagerty "merged", which effectively took Hagerty public in 2021 and is now listed under ticker symbol

HGTY. For a company wishing to go public, using the SPAC route, as compared to the traditional IPO route, allows for reduced degree of oversight from regulators and a lack of disclosure from the SPAC, burdening retail investors with the risk ......... okay.......

Note that State Farm owns 15% of the company, and Markel owns almost a quarter of the company below:

Look below:

Look below:

- HGTY entered a joint venture with Broad Arrow - a collector car auction company.

- HGTY bought Speed Digital, a company that was owned by a director on HGTY's board!!!!!!! JEEZ!!! Is the board looking after shareholder interests, or is the board looking after its own interests??!?!!??!

I am not an expert (or even an amateur) at evaluation an insurance business, but this is not what I would expect to see from an insurance business below (discussion about cash declining). If you look at GEICO (BRK) their discussions in their 10Q often talk about having way too much cash. There's so much cash going into BRK that they don't know what to do with it. Of course BRK needs the huge cash reserve to plan in advance for catastrophe .... but HGTY doesn't look like they have the "way too much cash coming in" problem.....

And finally for the kicker, because I'm getting too bored with this and this is too dry, I note this below:

And finally for the kicker, because I'm getting too bored with this and this is too dry, I note this below:

Oh Krist-almighty!!!! ARE YOU KIDDING ME?!?!?!?!?!?!

Oh Krist-almighty!!!! ARE YOU KIDDING ME?!?!?!?!?!?!

insider.hagerty.com

insider.hagerty.com