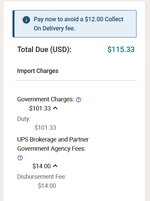

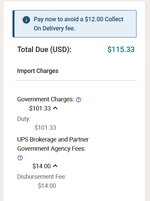

In early October, I purchased an item on eBay, from a seller in Europe. eBay did have a warning that additional duties would be due on delivery. The total was ~$200 USD. I figured maybe $50-$60 in duties, like 30% tops, right? The Seller shipped UPS Expedited, which was nice, and delivery took less than 1 week (!). But the duty invoice from UPS... not so nice (see below).

ZERO explanation beyond what you see in the screenshot. No itemized invoice. Just "Give us money now, or pay even more if you wait to pay at delivery." Nearly SIXTY PERCENT on top of the item price. Insane. I'd like to see the invoice details to figure out what is going on there. Guess I should be happy it's not over 100% like some other people had to pay (link)?

More info at this Reddit thread. Seems like UPS is extorting people because, well, they can. Very likely there are embedded UPS fees which they are trying to hide. Items I bought are made in Germany, not China, btw, since COO may have a bearing on the tariffs - no way to know for sure, because again, UPS does not itemize nor explain anything.

In the meantime, if buying from overseas on eBay, try to get the seller to ship with eBay's Global Shipping Program. That will display the duties / fess up front BEFORE you pay, No surprises afterwards. Some sellers don't understand the GSP and/or are unwilling to offer that, because they don't understand it. (As a seller, I've used GSP to ship items from USA overseas, it's easy and painless.) More details on eBay's tariff page here.

I'm curious if this is mostly a UPS problem or if other international shippers are hosing us too. Regardless, plan on up to 100% tariff/duty and be happy if it's less.

ZERO explanation beyond what you see in the screenshot. No itemized invoice. Just "Give us money now, or pay even more if you wait to pay at delivery." Nearly SIXTY PERCENT on top of the item price. Insane. I'd like to see the invoice details to figure out what is going on there. Guess I should be happy it's not over 100% like some other people had to pay (link)?

More info at this Reddit thread. Seems like UPS is extorting people because, well, they can. Very likely there are embedded UPS fees which they are trying to hide. Items I bought are made in Germany, not China, btw, since COO may have a bearing on the tariffs - no way to know for sure, because again, UPS does not itemize nor explain anything.

In the meantime, if buying from overseas on eBay, try to get the seller to ship with eBay's Global Shipping Program. That will display the duties / fess up front BEFORE you pay, No surprises afterwards. Some sellers don't understand the GSP and/or are unwilling to offer that, because they don't understand it. (As a seller, I've used GSP to ship items from USA overseas, it's easy and painless.) More details on eBay's tariff page here.

I'm curious if this is mostly a UPS problem or if other international shippers are hosing us too. Regardless, plan on up to 100% tariff/duty and be happy if it's less.