So I wanted to try this on a car with which I wasn't particularly familiar, but had some marginal level of interest in doing the comp research.

I went with the '96 Corvette 6speed with LT4. 11k miles. Looks like a pretty nice example of a late C4.

Bid for the chance to own a 11k-Mile 1996 Chevrolet Corvette Collector Edition 6-Speed at auction with Bring a Trailer, the home of the best vintage and classic cars online. Lot #31,147.

bringatrailer.com

Punched it into that estimator and here are the results:

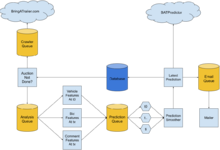

Car Auction Price Prediction on BringATrailer.com

batpredictor.cognitivesurpl.us

I was thinking $18-22K for final value before the vig. That website suggests a range of $866 to $1170.

Then I tried a garbage FJ60. Should hammer in the $15-20K range.

Bid for the chance to own a 1984 Toyota Land Cruiser FJ60 at auction with Bring a Trailer, the home of the best vintage and classic cars online. Lot #31,130.

bringatrailer.com

The estimator suggests $8600-12900.

#NotReadyForPrimeTime

Hello! I wrote the BAT Predictor system. I'm still working out the details on how exactly I want to deal with the first day or two of data where we have *very* little in the way of actual bidding (e.g. throw out the stuff where people bid $1,977 because it's a 1977 car etc), or just in general very little information about the trajectory of the auction. If you look at the1996 corvette now, we're 3 days out and the valuation is basically agreeing with you now (note that I didn't play with any numbers to respond here, it just takes a day or two to start narrowing into the actual final results):

BringATrailer.com Price Predictor.

The FJ60 that should be in the $15-20k range is now reporting at $13-21k which is about where you're expecting:

BringATrailer.com Price Predictor

The problem you're citing is definitely valid and I'm looking into a way to get the machine to make a better-principled guess when the auction is just starting up. After the first two or three days though, the model has latched onto basically the same numbers you have, but automatically. The value add for this modeling stuff is twofold: first, it requires no human intervention to get to the same price point you're saying here (albeit it was a day or two later than you), and second, because it has a huge corpus of data about makes/models, it can do some interesting projections / analysis that may be valuable. Here's the output from the database for W124's, in terms of historical record keeping as well as future inventory predictions:

```

{"make":"Mercedes-Benz","model":"Mercedes-Benz W124 E-Class","model_url":"

W124 E-Class","mileage_average":93361.34453781512,"full_count":239,"full_success_count":"79%","full_low":1900,"full_avg":15519.905263157894,"full_high":77777,"full_performance_above_expectation_pct":"-2%","full_price_trend":"0%","prev_90_day_count":27,"prev_90_day_success_count":"66%","prev_90_day_low":3500,"prev_90_day_avg":15314.666666666666,"prev_90_day_high":37500,"prev_90_day_performance_above_expectation_pct":"-4%","prev_90_day_price_trend":"0%","probability_of_sale_next_90_days":"99%","probability_of_auction_next_90_days":"99%"}

```

Happy to answer more questions about the modeling - you're right that it was off initially on those cases. It's a complicated mess trying to get the model to predict the right answer the second an auction goes online - I may end up feeding data about historical highs/lows for the given make/model, which would basically totally eliminate the issue (right now the model just considers attributes about the specific individual auction rather than larger market conditions, which is good in some ways but more rickety in others, like this situation). Sorry to barge in but I did want to provide some more info!